Insurance companies are facing a new challenge: the metaverse. This digital world is changing how insurtech firms think about risk, talk to customers, and use data. Many insurance leaders are unsure how to get their data teams ready for this new reality.

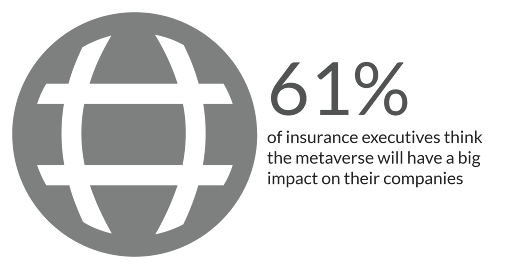

A study by Accenture found that 61% of insurance executives think the metaverse will have a big impact on their companies. This shows that many insurtech firms know they need to prepare for this digital shift. But they’re not sure what skills their data teams need or how to use metaverse technologies in their work.

The metaverse brings up lots of questions for insurtech companies. How can they get their data teams ready? What new risks and chances does this virtual world create for insurance products? How will analyzing data and talking to customers be different in the metaverse?

These are big questions that need answers. Insurtech leaders want to know how to help their data teams do well in the metaverse. They also want to understand how this new technology might change their business. In this blog, we’ll look at these issues. We’ll give practical advice to help insurtech companies and their data teams get ready for the metaverse.

The metaverse is becoming more important in the insurance technology (insurtech) industry. But what exactly is the metaverse?

It’s a virtual world where people can interact, work, play, and even buy things using digital versions of themselves called avatars. As more people and businesses use these virtual environments, insurance companies are seeing the need to change their services and how they work.

Research shows that the metaverse market is growing fast. According to Grandview, it’s expected to reach $936.57 billion by 2030. This big growth means the metaverse will likely become a key part of many industries, including insurance.

The metaverse offers several good things for insurtech companies:

These benefits explain why many insurance leaders are interested in the metaverse. By using this technology, insurtech companies can stay competitive and meet their customers’ changing needs in both virtual and real-world spaces.

However, moving into the metaverse also brings challenges. Insurance companies need to think about new types of risks in virtual worlds. They also need to make sure their data is secure and private in these new environments.

And insurtech companies that prepare early will have an advantage. They’ll be ready to offer new services, work more efficiently, and meet their customers in these new virtual spaces. This preparation involves not just understanding the technology, but also thinking about how it will change the way insurance works.

The metaverse is set to change a number of major areas in the insurtech industry. These changes will affect how insurance companies operate, interact with customers, and manage risks. Understanding these impacts can help insurtech firms prepare for the future and take advantage of new opportunities. Let’s look at the main areas where the metaverse will likely have a huge effect on:

The metaverse opens up new possibilities for insurance products. It creates virtual assets and activities that need protection, just like physical ones. This means insurtech companies can create new types of coverage tailored to the virtual world. These new products can help insurers reach new markets and meet emerging customer needs.

Examples:

The metaverse can transform how customers interact with insurance companies. It offers immersive and interactive ways to engage with insurance services. This can make complex insurance concepts easier to understand and processes more user-friendly. Improved customer experience can lead to higher satisfaction and loyalty.

Examples:

The metaverse provides new tools for assessing and understanding risks. It allows for detailed simulations and data collection in virtual environments. This can lead to more accurate risk models and pricing. Insurers can use these insights to improve their underwriting processes and offer more precise coverage.

Examples:

The metaverse can streamline and improve the claims process. It offers new ways to investigate, verify, and settle claims. This can lead to faster processing times and more accurate assessments. Improved claims handling can enhance customer satisfaction and reduce fraud.

Examples:

The metaverse provides new opportunities for employee training and skill development. It offers immersive learning experiences that can be more effective than traditional methods. This can help insurtech companies build more skilled and adaptable workforces. Better-trained employees can provide higher quality service and drive innovation.

Examples:

The metaverse generates vast amounts of new data. This data can provide insights into customer behavior, risk patterns, and market trends. Insurtech companies can use this information to make better decisions and create more targeted products. Advanced analytics in the metaverse can lead to more personalized and efficient insurance services.

Examples:

To succeed in the metaverse-driven insurtech field, data teams need to develop specific abilities. These skills will help them address the unique challenges and opportunities of virtual environments. Building these abilities, data teams can help insurtech companies use the metaverse effectively, creating new solutions and improving customer experiences in virtual spaces.

Data professionals should understand VR and AR technologies. This includes 3D modeling, spatial computing, and immersive interfaces. Familiarity with VR/AR development tools is also helpful.

As virtual economies grow, understanding blockchain and digital currencies becomes key. Data teams should know about smart contracts and digital financial systems.

The metaverse will create new types of data. Teams need skills in processing and analyzing large datasets from virtual spaces. This includes machine learning and AI tailored to metaverse data.

Protecting data and assets in the metaverse requires specific security knowledge. This covers virtual identity protection and secure transactions in digital spaces.

The ability to show data in three-dimensional formats is valuable. Creating interactive, spatial data visuals for virtual environments is important.

Knowing how virtual spaces work helps in creating effective insurance solutions. This includes user experience design in 3D environments.

Knowing programming languages used in metaverse development, like C# and JavaScript, can be useful.

As virtual items gain real-world value, pricing digital assets becomes important. This requires understanding virtual economies.

Staying informed about regulations for virtual worlds and digital assets is necessary. This includes data privacy laws in the metaverse context.

Skills in linking metaverse data with traditional insurance systems are valuable. This involves understanding how to make different platforms work together.

Preparing your data team for the metaverse is a step-by-step process that requires planning, training, and hands-on experience. This preparation will help your team adapt to new technologies and ways of working in virtual environments. Here’s a detailed guide to help you get your data team metaverse-ready:

Start by evaluating your team’s existing abilities. Compare these skills to what’s needed for metaverse-related work. This assessment will help you identify gaps in knowledge and expertise. Use the results to create a targeted training plan for your team.

Develop a structured training program based on your skill assessment. Focus on key areas like virtual reality, blockchain, and advanced data analysis for virtual environments. Set clear learning goals and timelines for your team members. Provide a mix of online courses, workshops, and self-study materials to cater to different learning styles.

Set up a test environment where your team can practice using metaverse technologies. This could include virtual reality headsets, 3D modeling software, and virtual world platforms. Allow time for experimentation and learning through trial and error. Encourage team members to share their experiences and insights with each other.

Partner your data team with other departments working on metaverse projects. This helps them understand different aspects of metaverse applications in insurance. Set up regular meetings or workshops for knowledge sharing between teams. Consider creating cross-functional project groups to tackle metaverse-related challenges.

Send team members to conferences and workshops focused on the metaverse and its impact on insurtech. This keeps them updated on the latest trends and technologies. Encourage attendees to present their learnings to the rest of the team after each event. Consider hosting internal events or inviting speakers to share insights with your entire organization.

Begin with small-scale metaverse-related projects. This allows your team to apply their new skills in practical situations without overwhelming them. Choose projects that align with your company’s goals and have clear, achievable objectives. Use these projects as learning opportunities and encourage team members to reflect on their experiences.

Invite metaverse specialists to work with your team. They can provide insights and help your staff learn from real-world experiences. Consider setting up mentorship programs or temporary assignments with these experts. Use their knowledge to refine your team’s skills and approach to metaverse challenges.

Make sure your data systems can handle information from virtual environments. This might mean upgrading storage, processing power, or adding new tools for 3D data. Work with your IT department to identify and implement necessary changes. Train your team on using these new systems effectively.

Train your team on the unique security challenges in the metaverse. This includes protecting virtual assets and securing transactions in digital spaces. Develop guidelines for handling sensitive data in virtual environments. Regularly update your security protocols as new metaverse-related risks emerge.

Encourage your team to stay curious about metaverse developments. Set aside time for them to explore new tools and share knowledge with each other. Create a system for sharing interesting articles, research, or new technologies related to the metaverse. Recognize and reward team members who actively contribute to the team’s metaverse knowledge base.

The metaverse is changing how insurance companies work with data. Getting your team ready for this shift is valuable to staying ahead. Through building new skills, trying out virtual tools, and keeping up with new trends, your data team can help your company make the most of the metaverse. Starting this process now puts you in a good position for the future.

Ready to build a data team that can excel in the metaverse? We here in Talentguy.io specialize in finding top data talent for insurtech companies. Our experts can match you with data professionals who have the right skills for this new digital era.

Don’t let the metaverse catch you off guard. Contact us today!