What’s causing the rapid demand for machine learning and AI expertise in fintech? As digital transactions multiply, so does the sophistication of financial fraud—a growing threat that traditional security methods can’t outsmart. Fintech companies nowadays will need data scientists who can use machine learning and AI to detect risks faster and adapt to new threats in real-time.

A recent N-iX survey found that 60% of leading fintech CEOs view machine learning and AI as the most potent tools against financial fraud, including money laundering. Unlike rigid detection systems, these technologies develop alongside new fraud tactics. Data scientists equipped with AI and machine learning skills don’t just analyze – they anticipate, bringing a level of defense that transforms how fintech can protect its data.

So, which skills should you prioritize when hiring data scientists for fintech? And how do you ensure they have the expertise to meet these unique demands? Keep reading as we break down the must-have AI and machine learning skills that can help safeguard your fintech’s future.

In Fintech, data science goes far beyond analyzing numbers. It’s a driving force behind the latest applications of artificial intelligence (AI) and machine learning (ML), but how do these two fields differ when applied to finance? That’s where many hiring managers find themselves scratching their heads.

From fraud detection to predictive customer insights, AI and ML impact fintech companies’ operations. How are AI and ML used in Fintech?

Let’s break down the practical uses of each:

Machine learning shines in fraud detection by identifying suspicious transactions with high accuracy. ML models process vast transaction datasets, recognizing unusual patterns and flagging potential fraud. For example, if someone’s credit card is suddenly used halfway across the world, ML algorithms may detect that as a red flag, potentially saving both the customer and the bank time and money.

Fintech companies use machine learning to tailor financial products, such as loan offers or insurance plans, to individual customer profiles. Analyzing customer data, such as spending habits and income patterns, means that ML can suggest products that better fit each person’s needs. Picture it as a financial “matchmaking” system, where customers get offerings that make sense for their specific situation.

ML’s predictive capabilities benefit investment decisions, especially in forecasting stock trends or market shifts. With algorithms trained on historical data, ML models can offer projections that help financial analysts and customers make informed decisions. This insight has become highly desirable in a world where financial markets are constantly changing.

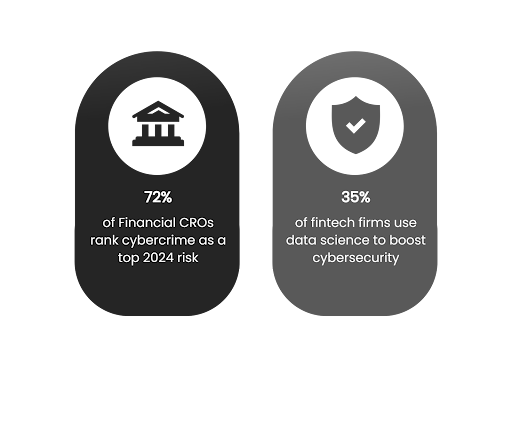

AI has become a powerful tool for cybersecurity, particularly in detecting and responding to cyber threats. A recent survey from N-iX showed that 72% of financial CROs rank cybercrime as a top risk in 2024, with 35% already using data science to enhance their cybersecurity strategies. AI models in cybersecurity analyze network traffic for anomalies, helping institutions respond to potential threats before they escalate.

AI-powered chatbots and virtual assistants have transformed customer service in fintech. These tools handle common customer queries, from checking account balances to resetting passwords, without human intervention. Think of it as having a personal banking assistant ready to answer questions anytime, even outside business hours.

Traditional credit scoring models rely on fixed metrics, but AI models incorporate a broader range of data points, often improving the accuracy of credit assessments. This approach allows for real-time credit scoring, which is particularly beneficial for underbanked customers. By integrating diverse data, AI helps financial institutions assess creditworthiness with more nuance, opening doors for those who might not qualify under traditional methods.

Data scientists are a real asset in Fintech. They fuse technical skills with analytical savvy to meet the industry’s demands. Their work is anything but analyzing numbers—they’re transforming mountains of data into strategies that strengthen growth, security, and customer experiences.

But what do they bring to the table? Data scientists and their AI/ML skills pave new paths in Fintech, from smarter decisions to safer systems.

Here’s how they’re reshaping the industry from the inside out:

Data scientists take raw data and turn it into insights that steer Fintech companies in strategic directions. By recognizing patterns, they clarify market trends and uncover opportunities that support better planning and product innovation.

Data scientists analyze customer touchpoints to create comprehensive views of the entire customer journey. This helps pinpoint areas of friction and identify engagement opportunities, ultimately leading to personalized onboarding, proactive support, and improved customer satisfaction.

Analyzing patterns and detecting anomalies lets data scientists identify potential risks before they snowball. This proactive approach helps Fintech companies manage risks, prevent losses, and sustain smooth financial operations—keeping surprises to a minimum.

Armed with AI-driven insights, data scientists help Fintech firms experiment with new features and products efficiently and data-informedly. From refining product designs to evaluating feature impact, data scientists ensure development aligns with user expectations and adapts to market shifts.

Predictive maintenance could also benefit Fintech. Data scientists develop models that predict potential issues, reducing downtimes and keeping operations running smoothly while saving on maintenance costs.

As companies grow, data scientists lay down frameworks that handle increased data and user loads. With robust architecture, real-time processing, and effective cloud integration, these systems ensure Fintech businesses can scale smoothly without disruption.

Regulatory requirements change constantly. Data scientists build models that adapt to new regulations, helping companies remain compliant without sacrificing operational efficiency.

Data scientists work with finance, marketing, and operations, bringing data insights to shape company-wide decisions. This collaborative approach creates a unified, data-driven strategy across teams, streamlining efforts and achieving more aligned outcomes.

Data scientists analyze operational costs and highlight areas where Fintech companies can streamline resources. Insights into staffing, resource allocation, and process efficiencies support a more financially balanced approach to growth.

Privacy is a significant factor in customer trust, and data scientists contribute models that protect user data while maintaining insight quality. This balance between security and accessibility ensures companies respect user data and deliver actionable insights.

You’ve decided that your Fintech team could benefit from AI and ML expertise – great. But you’re probably wondering how to find candidates with the right skills in both areas. Each role demands different capabilities, mainly when applied to financial services.

AI experts often work on broad problem-solving using algorithms and automation, while ML specialists focus on training models to improve predictions and analysis. Which one should you choose? And how can you even tell if someone is truly ready to take on these tasks in a high-stakes industry like Fintech?

Here’s a rundown of criteria to help you evaluate candidates with the right AI or ML background for your Fintech team:

Prior experience on actual projects speaks volumes about a candidate’s capabilities. Look for candidates who’ve worked on projects where they applied AI or ML models to solve real-world challenges. Sample projects might include:

AI and ML are only as good as the data behind them. Look for candidates who can handle large datasets and ensure data quality, as messy data can easily lead to poor model performance. Familiarity with data cleansing, preprocessing, and transformation tools is valuable here.

Fintech operates in a regulated space where understanding compliance can be as valuable as technical skills. Candidates who know how to build models that respect privacy laws and financial regulations are often preferred. It’s helpful if they’re up-to-date on relevant regulations, such as anti-money laundering laws and data protection requirements.

Tools and frameworks are essential in the daily work of an AI or ML expert. It’s a good sign if a candidate has experience with popular tools and can adapt quickly to new ones. Some widely used tools include:

Working in Fintech means facing complex challenges where AI and ML expertise alone aren’t always enough. Candidates must demonstrate analytical thinking, ideally with examples of problems they’ve solved. Strong problem-solvers often know how to pivot their approach when something doesn’t go as planned.

AI and ML expertise can feel like a foreign language to those outside the field. It’s beneficial to find candidates who can translate technical findings into language accessible to colleagues and stakeholders. Look for candidates who have a track record of:

By now, you’ve already found out that hiring data scientists with AI and ML skills can significantly enhance your operations. To maximize this expertise, identify specific areas where data-driven insights could elevate your offerings or improve security. Consider each candidate’s ability to adapt their skills to real-world Fintech applications and their potential to collaborate across departments. As you look ahead, ask yourself: what could a data scientist unlock for your company’s future growth and resilience?

At Talentguy.io, we specialize in recruitment and talent management, ensuring you find candidates with the right AI and ML skills to meet your needs. Our team is dedicated to helping you build a strong workforce that drives innovation and keeps you competitive. Reach out to us today, and let’s transform your hiring strategy to secure the talent that will push your company toward new heights.